Client Newsletter Example: Fed Remains Consistent - Indexes Achieved Short-Term Resistance - Managing Portfolios and Risk Tips

Published on January 27, 2022 @ 10:04am

The Fed said nothing yesterday that we didn't already expect him to say, but the NASDAQ 100 and S&P 500 did run into short-term resistance. Bottoms are a process not an event, but once again here is a reiteration of certain levels for QQQ and SPY that will need to hold by close of trading tomorrow - in order to suggest the worst might be over for now. Cautious optimism remains the theme for now. Also, portfolio management tips for the short-term trader and long-term investor - using protective stops, when to average down, when to keep something and when to cut it.

Fed Remains Consistent - Indexes Achieved Short-Term Resistance - Managing Portfolios and Risk Tips

Before I get into what happened yesterday, and more importantly what we're seeing now, I just want everyone to remember the worse things get, the better they will get for the buy and hold investor. Why? Most retail investors with a buy and hold mentality will end up cutting their long-term holdings at the maximum point of pain. Rather than staying the course, they will fall victim to the financial media's rhetoric, only to look back and wish they had held those higher quality names and index ETFs.

Of course this is very different from the short-term trader - who must exercise tremendous discipline to stay in the game, and more importantly remain profitable - no matter what market environment we're in. Pre-planned protective stops, taking profits when they're there, and using logical levels to get long or short are all part of a successful short-term trader's arsenal.

The long-term buy and hold investor, on the other hand, never has to realize a loss unless that loss is actually realized by selling something. So, when do we sell something, keep something, or possibly even average down in something? First, if the Company is fundamentally growing and delivering, those are the ones to keep. Anything else should be held with a very tight leash - always using stops. Then, when you have something of extreme quality that has been beaten to a pulp, one should most certainly consider averaging down on that idea.

However, therein lies the single biggest issue every buy and hold investor has the most trouble with - when to average down in something. I've been doing this a long time, and one of the biggest mistakes I see buy and hold investors make is averaging down too soon. Meaning, an investor has a position in something and is down in it, so they run out and average down because emotionally they're not dealing well with the loss they've incurred. Chalk it up to ego, or whatever we want, but the result ends up in averaging down too soon.

Instead, long-term buy and hold investors should only ever consider averaging down in a high quality name when the name in question has cratered 40% or more - unless of course something fundamentally disastrous has started to surface in that name. In that case, one might want to consider cutting it. However, if the name is of very high quality and is continuing to grow well enough, one should only consider averaging down if they can get their cost average dramatically lower than where it was previously.

As for index investing, the same goes, but the percentages are different. Considering index investing is focused on a collective of 100 names or more, 10%, 20%, or more makes sense, because the average return over the last 30 years for the S&P 500 still runs around 10% per year. Therefore, any correction of 10% or more should start to look attractive for anyone who is looking to take advantage of the next near-term bull market.

Lastly, investors also have a habit of fixating on a certain name that they're down in the most. Meaning, they only focus on averaging down on that one idea, because that one idea is their biggest pain point. Instead, it's often better to diversify into something of much higher quality that also has come off in a very big way. I know these rules are generally explained here, but if you look at your own situation and portfolio, I'm sure there's plenty to take away from all of the above.

What I'm trying to say today is while most investors start to let their emotions get the best of them, maybe it's better to look at it with an upside down kingdom principle that has helped so many savvy investors do well in their lifetime. Simply put, the uglier and more painful things get, the more attractive they should become - not the other way around. At the very least, you will put yourself in a position to manage anything and everything in a way that can more effectively manage long-term risk.

So what's happening with the broader equity market environment now? Yesterday, the Fed said everything we expected him to. He reiterated his commitment to the ongoing tapering process, while clearly communicating to investors his need to "potentially" raise rates this year. I say "potentially", because in the event things get even uglier in the equity markets, he may just end up kicking the idea of raising rates down the road. For now, however, we can expect him to start raising rates as soon as March - albeit only a modest token rate increase.

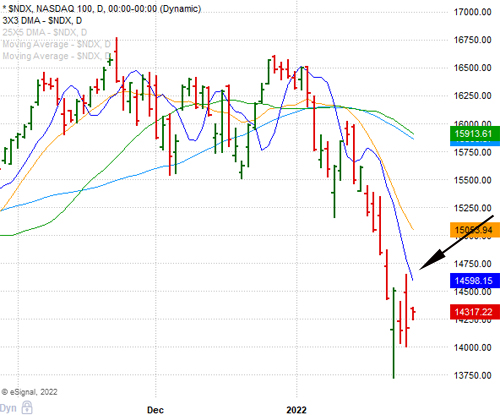

Technically, provided here are daily charts of both the NASDAQ 100 and S&P 500, which we will continue to fixate on. Why? These two indexes literally make up more than 90% of the highest quality names out there. So, it makes perfect sense these are the only two indexes investors and traders really need to pay attention to right now. Everything else is likely just going to follow suit, because nothing raises or lowers all ships more than the tide of the major indexes.

With that, you can see here both ran into short-term resistance around those 3X3 DMAs (dark blue curved lines) that I've been pointing to over the last couple of days. All very normal considering the recent downward thrusting behavior of the indexes. Now, we're about to find out if these markets are developing a bottom, or if we've got a lot more downside ahead.

As far as I'm concerned, the single most important number for what's to come when it's all said and done is whether or not the S&P 500 tracking SPY can close above $446 at the end of the day tomorrow. If it does, the bottom may already be in. If it doesn't, then even if these markets scream higher in the days that come, it may only end up being a shorting opportunity.

As for the NASDAQ 100 tracking QQQ, there doesn't appear to be any level that's going to end up being saved by day's end tomorrow, so even if these markets continue dramatically higher from current levels, we're going to have to be very vigilant and patient in the event both of these index ETFs end up going dramatically lower on the heels of any sharp rallies back to the upside.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst