Winnebago and Aimmune Therapeutics Pop - Market Update

Published on June 21, 2017 @ 8:17am

We got some great news this morning from one of our currently listed long-term ideas in Winnebago Industries Inc. (WGO). The Company reported a 75% surge in revenue and a 134% leap in gross profit even though it missed analyst estimates on its earnings per share line for its fiscal third quarter.

The bottom line, however, is the stock is up nicely in early morning trading. More importantly, Winnebago's results further support our ongoing theme of the aging Boomer looking to get out and travel, as well as a growing theme among Millennials to do the same. It's just not as much about consumers buying "things" anymore, as much as it is about experiences - specifically traveling.

As for the broader markets, we'll see if hump day ends up being slump day following yesterday's close below 6,193 on the NASDAQ Composite. It's still a little too soon to tell, however, we've been talking about the possibility of the markets staging a much bigger selloff than anything we've seen in a while.

The technical context we pointed to yesterday in order for the NASDAQ to be in a position to resume its June 9th selloff was a close below 6,193 on the Composite. We also mentioned a bullish trigger should the index close above roughly 6,255, but that hasn't happened yet.

It's still possible the index could reverse itself back to the upside, and more importantly take out that 6,255 level, but based on what happened yesterday, there's strong technical context at this point to believe these markets may finally start moving lower now. We're not out of the woods quite yet, but one more strong move lower as soon as today could end up triggering a resumption of that June 9th selloff - one that pulled the rug from many big tech names all in a single day.

Just goes to show the major indices - and even individual stocks - often move lower far faster than they move higher, especially in the type of market environment we've got right now. There's no question stocks have gotten a little long in the tooth - both technically and fundamentally - but it still remains to be seen if they're truly ready to rollover for a while.

We're assuming we'll find out this week, so for those of you who got short any of the bearish index ETF's in recent days, just remember if the NASDAQ Composite closes above 6,255, all bearish bets for the time being should be taken off the table. However, as long as the level is not breached to the upside, these markets will still be in a position to move lower.

Biotech continues to rip higher following our bullish analysis earlier this month regarding LABU - one of the bullish leveraged ETF's tracking the sector - and the biotech space in general. More on that in a second...

First, another one of our currently open short-term ideas in Aimmune Therapeutics, Inc. (AIMT) is also ripping higher. As you can see in this daily chart below, the speculative development stage biotech Company in phase III trials with its AR101 for the treatment of peanut allergy, has been volatile to say the least of late.

However, over the last few days, the stock not only put in a double bottom, it's also seeing follow through to the upside. And, based on what we're seeing now, could be well on its way to roughly $20 per share before we'd be in a position to potentially take some profits there.

Although we did recently suggest an exit of LABU for those who picked it up earlier in the month, we're still convinced biotech, healthcare and pharma may end up leading these markets higher once the major indices are ready to resume their long-term bullish trend.

We're noticing many small and large biotech stocks are starting to behave much better finally, which should be a welcomed event for many of you out there who like exposure to the space.

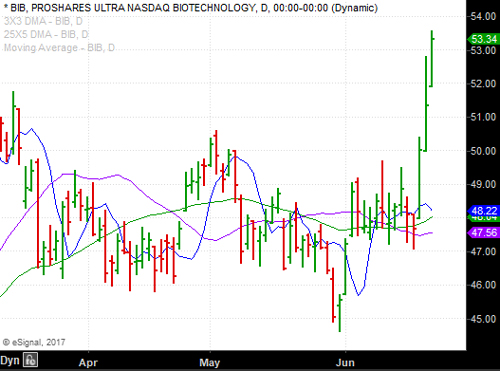

Below is a daily chart of BIB, another bullish leveraged ETF tracking biotech, and as you can see here, the ETF has made a tremendous move over the last few days.

Problem is, when you drill down into the weekly chart on much more of a long-term basis, you can also see the ETF has made a new multi-month high, and when we consider there's probably an overly crowded trade setting up to the long side across the entire biotech space in recent days, don't be surprised if these bullish leveraged ETF's tracking biotech end up getting reversed in fairly sharp fashion soon.

It would be at that point - depending on where the major indices are - we'd likely suggest getting long the space yet again, and more importantly start exposing ourselves to even more quality healthcare and pharma names, in addition to select biotech names, in anticipation of a much bigger move to the upside over the next several months.

Something's going to have to lead when these markets are ready to move much higher again, and considering the above mentioned sectors have been beaten down - both technically and fundamentally for quite some time - we're assuming this is where the value will end up being.

It's important to remember when it comes to stocks and the sectors they live in, money has no home. So, it's likely to be those lagging sectors, including small caps, that will lead these markets higher when it's time.

Tomorrow, we're going to provide a brief update on all of our open ideas, so stay tuned - we think you'll find value regarding what we have to say about many of these names.