Macro Fundamental View and Short-Term Technical Outlook - Oil, Gold and the Dollar

Published on August 24, 2017 @ 7:49am

Although the markets have had a few pretty good days, the recent downside momentum still favors the bearish side of the trade. As you can see in this daily chart of the NASDAQ, the highs have gotten lower despite the last few days of strength. And, although the Index could potentially find its way to that fourth arrow to the right here - which would put the index just above 6,300 or so - the negative trend would still suggest the possibility of much lower levels ahead.

The bottom line is until that downward trend is busted to the upside, these markets are still clearly in a position to move lower. Until the NASDAQ can break below Monday's low of 6,177 though, anything is possible.

You can also see if you're looking to get long or short the major indices, you can't just jump in the middle somewhere, you've got to use key pivot points to enter into a trade. In other words, those key pivotal tops, or pivotal bottoms, which we would not suggest getting long the index ETF's until a point the negative bias has changed, or the NASDAQ achieves roughly 6,000 to the downside.

Long-term bonds continue to quietly move higher via the weekly chart of TLT here, which doesn't bode well for stocks on a near-term basis. Although there have been time periods in recent years where both move higher in tandem together, it's definitely not normal, so a flight to bonds does suggest a flight to safety of late.

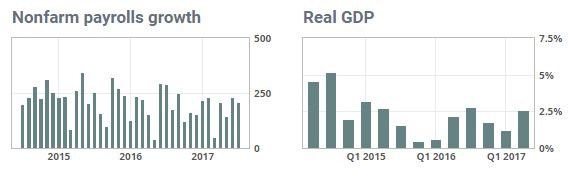

From a macro fundamental view, nothing has really changed on the economic front, literally. Payrolls and GDP continue to move pretty much sideways for the most part - suggesting ongoing slow growth, so no real major concern there. However, from an S&P 500 price and earnings perspective, there continue to be a few concerns.

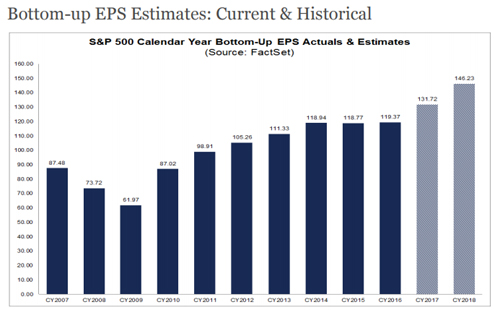

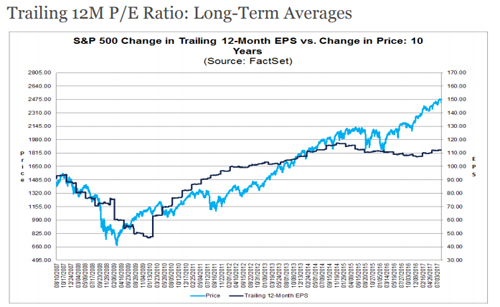

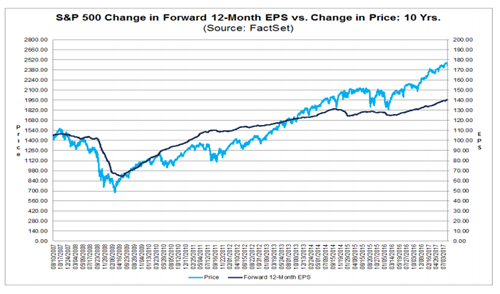

First, the bulls continue to hang their hat on upward revisions and bottom up EPS growth over the next few years, which you can see in the bar chart below. What they're not telling you is how far away these markets have gotten from some key fundamental metrics - specifically S&P 500 trailing P/E's and forward EPS (earnings per share).

You can see here in the second two charts below the S&P 500 Index continues to get away from trailing P/E's and forward EPS in recent months. Meaning, the Index has priced itself for perfection over the last several months. At some point, there's going to have to be at least some convergence between these key metrics.

Still, markets can often defy any fundamental data - economic or earnings - on a short-term basis, but on a long-term basis they will ALWAYS come back to a mean of sorts.

The bottom line is the forward earnings landscape remains attractive, but the markets have gotten a little ahead of themselves. So, although we've yet to get any sort of definitive correction to suggest a return to this "mean" mentioned above, it is important for investors to know the truth - the markets have gotten pretty over extended in recent months.

No real change recently between oil, gold and the dollar. Although the dollar did confirm a pretty reliable reversal signal back on August 15th, the currency still continues to languish looking for a base. However, the reversal signal is still intact. Meaning, we "should" see further strength to the upside on the dollar from purely a technical perspective.

With that, oil and gold both continue to waffle with no definitive move in either direction over the last several days. But, our analysis still points to lower levels ahead in both commodities on a near-term basis.

Again, we'll need to see a break below last week's low on the price of light crude if our recently suggested oil short is going to pan out nicely.

Individual Company Idea Updates:

None

Actions To Consider Today:

Buy XLU only if the major indices break down today.

Hold SQQQ and/or SPXU - just make sure to trail your gains with a mental stop in an effort to protect profits there.

Hold SCO - while also continuing to trail your gains with a mental stop there as well.

If you have any questions or would like further details regarding any of the information provided above, please call your Rep - 619-369-9316.