Markets Achieve Targets - Consider SPXL and/or This Investing Strategy - Oil Achieves Key Levels

Published on June 3, 2019 @ 1:06pm

Markets finally achieve levels to suggest a potential reversal looms. We'll need proof though. S&P 500 levels to eye. Any forward market strength will be a good time to exit any under performers. Oil also achieves levels to suggest a potential reversal. What we'll need to see there as well.

First Downside Targets Achieved - What to Expect and Look for Now

It's been very well documented here in the newsletter for about a month now we were fully expecting the DOW and the S&P 500 to get down around roughly 24,800 and 2,750 respectively before all of the major indices could be in a position to reverse their recent downtrends. Well, we're finally here. However, just how long any potential reversal is going to last is going to be an issue.

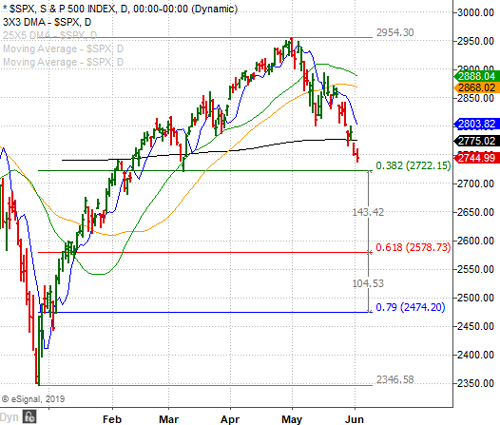

Provided here are daily charts of both the S&P 500 and the DOW. As you can see, both indices have now pretty much achieved their 3/8ths retracement levels from their late December bottoms to their May 1st highs. Meaning, it's very logical these markets could be in a position to start moving higher any day now - specifically back toward 2,816 on the S&P 500 and 25,474 on the DOW.

It should be at either of those levels these markets should run into resistance again, and more importantly tell us if a bottom has been put in, or if we're in for more downside ahead. However, considering the breadth of the recent month long decline, it's going to take quite a bit of bullish activity to suggest a bottom has been put in.

Just about everything out there has been crushed in recent weeks, but we all know how quickly things can change. Therefore, we're going to go ahead and suggest a speculative "first half" position in the bullish leveraged ETF tracking the S&P 500 in SPXL if and when the S&P 500 achieves 2,722 or thereabouts. Then, look for these markets to stage at least a short-term reversal back to the upside.

We'll only suggest half of what you might be willing to allocate toward SPXL because pegging perfect entries into any index trade is difficult for even the most successful traders on the planet. Meaning, you could enter half around that level, and the other half if and when the S&P 500 gets close to 2,700 or slightly below it.

You will have to keep a very short leash on the trade in the event these markets surprisingly don't end up staging a reversal soon, as no reversal around current levels would clearly suggest much lower levels ahead. Therefore, if you're not comfortable playing any potential reversal now, you could always sit on the sidelines and look to potentially enter into another index short if and when the S&P 500 and/or the DOW achieve those above mentioned upside targets.

Now that these markets have gotten down around pretty logical reversal levels, this is where things start to become dicey. It's all about trade management because even though these markets "should" reverse now, there's clearly no guarantee they will. Meaning, it's all about risk/reward, so be full willing to accept whatever takes place over the next several days.

The bottom line is although persistence does breakdown resistance, the truth is stocks usually take the path of least resistance. In other words, the trend is your friend until proven otherwise.

Consider Cutting Under Performers On Market Strength - A Strategy to Employ

There's no question these markets are clearly in a downtrend now until proven otherwise. Although we do have some strong technical context for a bullish reversal to start developing as soon as today, these markets still have a lot to prove before we're going to start getting bullishly aggressive again.

We mentioned weeks ago everyone should consider cutting those bullish ideas you weren't comfortable holding on an extremely long-term basis. Now, for those who didn't, you may want to consider doing so on any forward market strength.

Why? There's an old saying in the markets that's ringing true right now - it's better to be out wishing you were in than in wishing you were out. And, considering just how negative the ongoing momentum and sentiment have been in recent weeks, holding market under performers probably isn't wise.

Rather, long-term investors could overweight to QQQ and SPY - the two primary non-leveraged ETFs tracking the NASDAQ 100 and S&P 500, and then keep some dry powder for those attractive swing trading opportunities that will continue to surface week in and week out. The current volatility in both directions isn't likely to subside anytime soon, so there's going to be plenty of profitable swing trading opportunities to surface now and well into the future - both in leveraged ETFs and many individual quality companies.

Further, by holding those two market leading ETFs, you have very quality exposure to over 500 of the best companies on the planet in the event these markets start to behave better soon. Not only that, all of our research has revealed QQQ and SPY to be the best performing ETFs over the last few decades, and we definitely don't expect that to change - unless of course these markets continue to break down substantially.

Still, these markets have and will continue to historically prove they're always going to make new all-time highs - it's never a matter of if, just a matter of when. Therefore, by owning QQQ and SPY, you're ensuring some nice gains once these markets start to correct themselves back to the upside.

For the record, QQQ has averaged about a 40% annualized gain over the last ten years, while SPY has posted about a 10% gain per year since its inception back in 1993, and that includes every major market selloff since. Therefore, some attractive long exposure in those two ETFs has its merit, while swing trading these markets for profits on a short-term basis also has its merit.

Oil Achieves Key Retracement Level - Potential Reversal Looms

Just like what happened in the fourth quarter of last year, oil broke down right around the exact same time the major indices broke down. This time around has been no different. However, oil also bottomed in a big way in late December - exactly at the same time the major indices bottomed as well.

Is oil on the verge of staging at least a short-term reversal soon? We believe so, but just like with all of the major averages we're going to need to see some semblance of a technical bottom develop before we'll be interested in getting long oil - especially since we're already suggesting SPXL.

Provided here is a daily chart of the price of crude, and as you can see, it's having a much better day today following several days of substantial weakness. And, it all comes right around another very key retracement level - one that should serve up a reversal soon along with the rest of the markets.

Again though, if for some reason we don't get a sharp reversal in oil at some point this week, it's not going to bode well for the overall market landscape right now. Therefore, we'll remain on the sidelines with oil and look to potentially suggest a bullish leveraged ETF like UCO once crude proves its ready to rally again.