Want a Good Look at What Our Subs Receive Every Day? Here You Go...

Published on September 20, 2019 @ 8:36am

No material change with major financial instruments. Major averages continue to hunt for near-term direction. Biggest portfolio killers and tips to drive short and long-term portfolio profits. A new small cap pick in Corcept Therapeutics Incorporated (CORT).

Major Indices Continue to Hold Up - No Material Changes Yet for Major Financial Instruments

We continue to maintain a number of open ideas, and even a few previously suggested ideas we didn't add to our list, in many of the major financial instruments out there right now. Everything from oil and gold to bonds, the dollar and even some sector based leveraged ETFs.

As it stands right now, we've seen no material change in any of those ideas except for our ongoing biotech sector short via LABD, the primary bearish leveraged ETF tracking the biotech space. However, we will be looking to cut the idea soon regardless of what happens over the next several days.

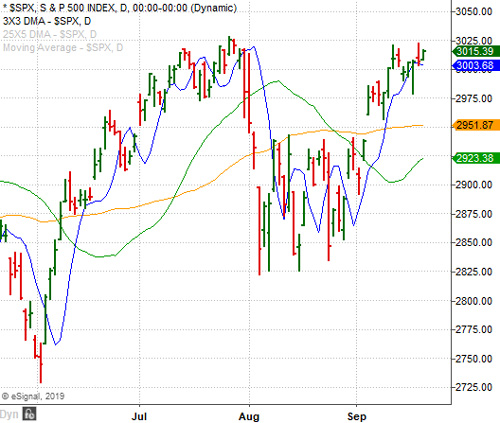

The major indices continue to waffle right around all-time highs again, while everything from gold to bonds and the dollar continue to hover around very key pivot points. Provided here is another updated daily chart of the S&P 500 showing you it made an attempt to test its all-time high yesterday, but ended up backing up before it could actually get there. However, it's precisely this type of chipping away that should eventually take these markets higher.

The question is whether or not it's going to back up even further before it does. At this point, we could see a move back to its 25X5 DMA (green line) on this daily chart here, which currently sits at 2,923, but the fact it continues to hold its 3X3 DMA (blue line) also suggests the possibility of higher levels ahead.

The bottom line is although things have been pretty quiet from a technical trading perspective lately, we all know that's going to change, and when it does it's going to be important to be well positioned. For all intents and purposes, our current open ideas reflect our ongoing stance on these markets on both a short and long-term basis.

Biggest Portfolio Killers and Tips to Help Drive Short and Long-Term Profits

I get an awful lot of emails and phone calls from time-to-time from many of you with questions regarding trading/investing strategies. I also receive many inquiries and questions many of you looking for a second opinion on an individual stock you own, have heard about elsewhere or are thinking about buying.

With that, I've assembled what I believe a very short list of the biggest portfolio killers, and a short list of tips on how one can improve their short and/or long-term portfolio performance.

First and foremost, many investors and trader participate in WAY too many overly speculative small and micro cap stocks that literally haven't proven their ability to substantially grow revenue and/or earnings. It's typically not a good idea to buy something just because someone has a great story about it. I prefer to focus on companies that actually have proven their fundamental worth already, have the necessary financials to grow their business, and do appear to have attractive forward growth prospects. Add all of that to a potentially attractive technical landscape, and you have a much higher probability of success for the idea in question. Even then, you or I are not always going to be right, which leads me to the next big tip.

Basically, it's imperative you participate only in high quality fundamental names and ETFs that trade high volume that are still fundamentally and/or technically attractive. The old adage buy low and sell high is all fine and good, but if you're not participating in proven companies and/or ETFs that have proved performance worthy, and are liquid enough to get in and out of them whenever you want, you're probably asking for trouble. I love to speculate as much as the next guy, but I will only speculate on something that has actually proven more than just a little fundamental something, and does appear to be technically attractive for more than just one reason.

Further, many investors and traders have a tendency to hang on to their losers way too long - especially when it comes to those overly speculative small and micro caps that haven't proven much of anything. There's absolutely nothing wrong with hold something for the long haul, as long as it's a very quality name that continues to prove it's still a good idea to hold it from a fundamental perspective. Cash and debt on the books are a big tell for any company, so it's always important to look at those two line items before deciding if you're going to continue to hold something or not. There's nothing wrong with cutting an idea when an idea goes south. We've all hung on to losers far longer than we should have at times, but that's human nature - we don't want to accept a loss. Trust me, it's better to cut something before the losses really pile up in the wrong idea.

Another one of the biggest market no-no's is being way too overly active - participating in just about anything and everything that comes your way - no matter where it comes from. I can't emphasize how important it is to be selective, and know when patience is warranted. There's nothing wrong with doing nothing sometimes - especially when the current market environment isn't offering any sort of definitive direction. As for us, remember, we're simply a source of ideas to help you be successful in the markets, so it's very important you only ever participate in those ideas you have strong conviction for after reading the context here in the newsletter for why we like the idea in question.

Know your strategy and stick to it. Play the long game or the short-term game, or a combination of both, but pre-define the strategy on the idea before you decide to enter. Hindsight is always 20/20 so don't spend too much time on the coulda shoulda woulda unless there's something definitive to learn from it. Know your strategy in advance of buying or shorting anything. In other words, before you actually buy or short something, determine in advance if you're going to invest in it for the long haul, or if it's simply a short-term swing trading idea you're going to attempt to shave for some profits.

Lastly if you don't fully understand how the options markets work, don't buy or sell them. Everything from liquidity to implied volatility are important toward determining whether or not an options trade is worth the risk. Consider the timeframes, and always give yourself ample time that makes sense based on the cost of your options' purchase - all in an effort for those options to end up being profitable. It's enough to identify an attractive fundamental idea that is starting to look technically attractive, but often times it takes time for the idea to play out. Meaning, when you add time to the equation things become even more difficult - yet many investors and traders get sucked into buying options because of how much leverage and how profitable they can be when right. Sometimes, it's better to just be a seller of options rather than a buyer of them.

A Perfect Example of Small Cap Worth - Corcept Therapeutics Inc. (CORT)

Considering all of the above, we're still always scouring the small cap markets for less speculative names that also continue to prove their fundamental and technical worth over most other small caps in the space. We've had a lot of success with certain small cap names over the years, but there's no question we've also had some losers.

We've had several monster homeruns in names like AMD and ENPH - initially suggesting them at low single digit levels, but we've also had some losers in names like BE and WKHS. Nevertheless, even the losers still have a legit shot at success - with some of them even having come back and moved higher from where we initially put them out there and ended up cutting them. That's the value of being selective with small caps that have actually proven their ability to drive revenue and/or earnings.

With that, I've approved one small cap name we'll go ahead and suggest today in Corcept Therapeutics Incorporated (CORT). This is a profitable development stage biotech with a current market cap of $1.58B. The Company trades at a current forward P/E of just over 14, just under 6 times sales, has over $200M in cash on the books, and a mere $1.15M in debt.

It still sports insider ownership of just under 10%, and is expected to grow its bottom line from this year to next by about 32%. That's great growth for a Company trading at just over 14 times earnings.

Cortisol dysregulation plays an important role in a variety of endocrine, metabolic, oncologic, psychiatric, and ophthalmologic diseases. Corcept leads the field in the research and development of selective glucocorticoid receptor (GR) antagonists, having discovered more than 500 proprietary molecules since being founded in 1998.

The Company already has one commercial drug in Korlym(R) (mifepristone), a cortisol receptor blocker indicated to control hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing's syndrome who have type 2 diabetes mellitus or glucose intolerance and have failed surgery or are not candidates for surgery.

Further, through collaborations with researchers around the world, Corcept has more than 30 studies underway to investigate the potential benefits GR antagonists may have in the treatment of serious and life-threatening diseases driven by cortisol dysregulation. It also has 11 candidates currently in its pipeline looking for approval, which can be found here: https://www.corcept.com/research-pipeline/pipeline/.

Technically, provided here is a daily chart of the stock. As you can see, it has definitely been trading better than most stocks out there over the last several weeks, and does appear to be on the verge of much higher levels - specifically $17 and change on a longer-term basis.

When you take a big step back and look at the monthly chart here, you can see shares of CORT have traded as high as $25 and change, so the technical pattern for CORT to move higher is clearly there when you consider its current valuation metrics and forward growth projections.

All in all, CORT is one worth speculating on based on fundamental and technical merit. Therefore, we'll suggest a spec. entry into CORT around current levels, and set a $17 price target on the idea. If things really start to pick up, and the Company provides any sort of positive clinical trial updates going forward, this is one development stage biotech that actually has more potential than just that $17 price target. However, like with every other small cap on the planet, it doesn't come without a fair amount of risk.

Top Suggested Long-Term Core ETF Holdings

Invesco QQQ Trust (QQQ) - 20%

SPDR S&P 500 ETF (SPY) - 20%

Utilities Select Sector SPDR Fund (XLU) - 10%

iShares U.S. Aerospace & Defense ETF (ITA) - 10%

Previously Suggested Short-Term to Mid-Term Trading Ideas

Corcept Therapeutics Incorporated (CORT) - Suggested 9/20/2019 @ $13.87

QUALCOMM Incorporated (QCOM) - Suggested 9/19/2019 @ $79.23

The Boeing Company (BA) - Suggested 9/19/2019 @ $386.70

Direxion Daily Aerospace & Defense Bull 3X Shares Direxion Daily Aerospace (DFEN) - Suggested 9/16/2019 @ $62.64

ProShares Ultra Bloomberg Crude Oil (UCO) - Suggested 9/16/2019 @ $19.99

HollyFrontier Corporation (HFC) - Suggested 9/16/2019 @ $52.25

VelocityShares 3x Long Gold ETN Linked to the S&P GSCI Gold Index ER (UGLD) - Suggested 9/10/2019 @ $138.86

Direxion Daily S&P Biotech Bear 3X Shares (LABD) - Suggested 9/3/2019 @ $22.16

Bristol-Myers Squibb Company (BMY) - Suggested 8/8/2019 @ $46.50

Ionis Pharmaceuticals, Inc. (IONS) - Suggested 7/3/2019 @ $65.23

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst