Client Newsletter Example: TQQQ and SPXL Back in Trading Focus - Adding GNRC, IHI and VHT

Published on March 31, 2020 @ 11:31am

Case counts in Italy and Spain starting to flatten. We shouldn't be far behind with our first day of declining case counts yesterday since March 21st. Still, one day does not a trend make. Major averages work to bottom around current levels. VIX and bond tea leaves suggest the bullish leveraged index ETFs TQQQ and SPXL are finally becoming attractive again, but not without more potential volatility. COVID-19 is likely to change consumer perception, how we live and how we trade and invest. Therefore, we'll focus on those essential stocks and ETFs likely to benefit from this evolving theme. With that, we'll suggest partial entries in GNRC, IHI and VHT.

Traders Update: Global Case Counts Start to Flatten - Markets Work to Bottom - TQQQ and SPXL Worth a Partial Spec. Entry

If we ignore the media's efforts to continue to spread more doom and gloom, and just look at the hard facts so far, it does appear the global case count curve for COVID-19 may finally be starting to flatten. Over the last four days now, both Italy and Spain have started to shows signs of a somewhat declining to flattening curve. However, we only saw one day of declining case counts here in the US - with yesterday being the first day of declining case counts since March 21st. Still, we're hopeful.

I also mentioned late last week if the primary ETF tracking the 20+ year treasury bonds in TLT could achieve roughly $171, and if the VIX (Volatility Index) could close above 63 on Friday, and then close back below that same number as soon as today, both technical events would add to the near-term bullish landscape for equities.

Provided here are daily charts of both - showing you TLT is almost at $171, while the VIX did confirm the "first half" of its potential reversal signal on Friday. Meaning, the VIX closed above 63 on Friday, and now needs to close below roughly 62 at some point over the next few days. Basically, if both of those events can confirm, it should be good for the very near-term landscape for stocks. It wouldn't necessarily mean the ultimate bottom is in, but it would suggest higher levels ahead for the major averages over the next several days.

Further, provided here are daily charts of both the NASDAQ Composite and S&P 500. Last week I mentioned 7,850 would be the upper band of short-term resistance for the Composite, and so far that has served traders well. However, when you consider the above, and we can preferably get the Composite down around or preferably below its 3X3 DMA, which now currently sits at 7,220, it would provide an optimal spec. entry back into TQQQ or SPXL, the two primary bullish leveraged ETFs tracking the NASDAQ 100 and S&P 500.

The problem is based on all of the above the NASDAQ Composite may not quite get to that 7,220 level or below before these markets could start building on last week's rally. Therefore, we'll suggest a partial entry into TQQQ or SPXL around current levels (whichever leveraged index you prefer), and then potentially suggest a second half entry if and when the Composite gets down around or below 7,220.

All things considered, it's still a little dicey on the case count front, so consider your risk tolerance before deciding to participate in a trade like this, and more importantly remember TQQQ and SPXL will move three times that of whatever the two above mentioned indexes do.

In other words, if the NASDAQ Composite and S&P 500 go up or down 10%, TQQQ and SPXL will accordingly go up or down roughly 30%. That's a big move, so set your share and total dollar amounts accordingly, and consider what you might be willing to lose in the event these markets surprisingly make new lows before moving sharply higher first.

The bottom line is we'll continue to keep you updated on all of the above in an effort to be on the right side of the markets' next big move. We just need to be careful of any dramatically rising case counts over the next several days.

Investors Update: COVID-19 Likely to Change Growth Themes Going Forward - Adding Partial Entries in GNRC, IHI and VHT

Another Federal extension on physical distancing (I like that term better) to April 30th now has people around the country wondering when this is all going to come to an end. So much so I'm very convinced what has happened is going to change the way consumers spend, what Americans deem to be important and essential, and more importantly for the equity markets a major change in growth themes.

With that, we're going to go ahead and suggest partial entries today into GNRC, IHI and VHT - with GNRC being added to our individual company idea list (see below), and the latter two being 5% allocation additions to our Suggested Long-Term ETF Holdings list (see below).

First, our power grid here in the US, and the obvious importance of power in the business and the home, is clearly an essential theme going forward with tremendous potential growth, and Generac Holdings Inc. (GNRC) sits at the epicenter of backup power solutions.

I've mentioned and suggested GNRC on a number of occasions before, but today we're going to go ahead and re-suggest a partial entry into the idea around current levels. The clear residential and commercial leader in backup power solutions, Generac has signed agreements to provide backup power solutions for both AT&T and Verizon's new 5G networks.

Additionally, the Company provides best-of-breed back power generators for both homes and businesses all around the country. Considering the potential impact of 5G on the US power grid, and any future natural disasters likely to occur, GNRC is one stock I think every investor should have at least a little exposure to.

With a current market cap of roughly $6B, this pure mid-cap play has managed to grow its balance sheet four consecutive years in a row. It's profitable, trades at roughly 18 times forward earnings, three times revenue, and is projected to grow its bottom line from this year to next by roughly 14%.

However, that does not account for any power grid issues likely to surface from time-to-time, as well as any further natural disasters likely to occur in the months and years ahead. Add that to the fact, backup power is likely to be an ongoing them with mobile medical efforts currently taking place here in in the US, and we have a recipe for what I believe to be a potential double in GNRC over the next few years.

Prior to the recent market-meltdown, GNRC was on a tear. However, it has since come back to levels that should provide long-term investors with an attractive entry back into the stock. Provided here is a monthly chart of the stock, and as you can see it has retraced as much as 40% from its 2016 low to its all-time high.

Therefore, we'll go ahead and suggest a partial entry around current levels, and tag it as a long-term hold. Then, if for some reason these markets end up moving substantially lower when it's all said and done, we'll suggest adding a second half position.

Remember though, it's important everyone addresses their own timelines and strategies, because I'm still convinced the ongoing market environment will continue to be a volatile one, so there's nothing wrong with taking profits when they're there - assuming of course GNRC starts to mend with the rest of the markets soon.

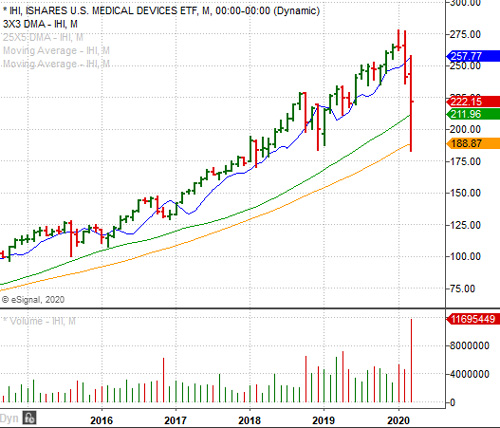

As for iShares U.S. Medical Devices ETF (IHI) and Vanguard Health Care Index Fund ETF Shares (VHT), both of these high quality liquid ETFs have also been smacked hard since these markets started moving dramatically lower only a month ago. However, both of these ETFs make up the most attractive medical device and healthcare companies on the planet. While IHI's holdings consists of those best-of-breed names in the medical device space, VHT sports an attractive basket of those highly attractive pharma and healthcare names.

Everything from Abbott Laboratories, Medtronic PLC, Danaher Corp. and Intuitive Surgical Inc. to Johnson & Johnson, UnitedHealth Group Inc. and Merck & Co Inc., know that between these two ETFs investors have an opportunity to create very broad exposure to what should become an even more attractive growth theme going forward, as both the medical and healthcare sectors should stand to continue benefiting from any futures virus concerns likely to surface again in the Fall and beyond.

Therefore, we'll suggest a partial allocation of 5% each in both ETFs, and add these two ETFs to our Suggested Long-Term ETF Holdings list (see below).

Current Stance for Equities:

Long-Term Bullish - Short-Term Neutral

Suggested Long-Term ETF Holdings:

Invesco QQQ Trust (QQQ) - 15%

SPDR S&P 500 ETF (SPY) - 15%

SPDR Gold Shares (GLD) - 15%

Vanguard Health Care Index Fund ETF Shares (VHT) - 5%

iShares U.S. Medical Devices ETF (IHI) - 5%

Individual Company Ideas:

Generac Holdings Inc. (GNRC) - Suggested Partial Entry 3/30/2020 @ $89.68

PepsiCo, Inc. (PEP) - Suggested Partial Entry 3/26/2020 @ $114.29

QUALCOMM Incorporated (QCOM) - Suggested Partial Entry 3/24/2020 @ $65.66

Alphabet Inc. (GOOGL) - Suggested Partial Entry 3/17/2020 @ 1,051.57

Advanced Micro Devices, Inc. (AMD) - Suggested Partial Entry 3/17/2020 @ $38.70

Wheaton Precious Metals Corp. (WPM) - Suggested 2/20/2020 @ $32.10

Sociedad Quimica y Minera de Chile S.A. (SQM) - Suggested 2/12/2020 @ $31.11

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst