Client Newsletter Example: Op-Ed On the Biggest Transitional Shift in 150 Years - VIX May Tell What's Next for the S&P 500

Published on August 20, 2020 @ 10:03am

Provided in today's newsletter is a very important op-ed as to why these markets are behaving the way they are, and more importantly why investors should be aware of all of it on more of a long-term macro level. As for the short-term minutia, the VIX may reveal what's next for the major indexes at today's close as the S&P 500 tests its all-time high for the second day in a row.

Major Indexes Still Chugging Along with No Clear Signs of Stopping Yet - Unless This Happens

Climbing a wall of worry? Sort of. But it's very important every trader and investor reads the below op-ed on what I think is really happening. While this particular section of the newsletter is always designed to cover what's happening in and around the markets from day-to-day, the next titled section below is a macro view of what we believe is actually happening on far more of a long-term basis.

More importantly, I also believe we're only in the first few innings of all of it. Does it mean these markets are simply going to continue higher and higher with no significant selloffs, crashes or deep pullbacks along the way? Absolutely not, but it is very important every trader and investor is aware of what's actually going on at the very macro level.

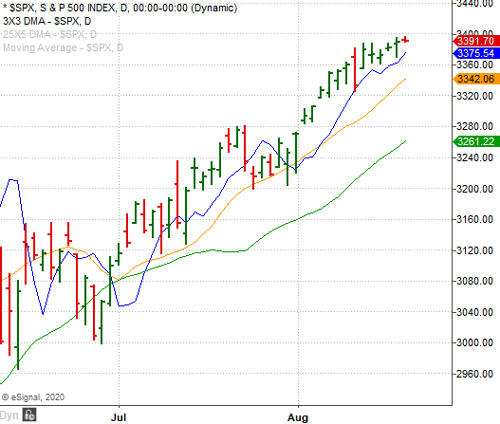

Before I get into that, you can see here on a very short-term basis the NASDAQ Composite simply continues higher - with literally nothing in the way technically right now to stop it from going higher. However, the farther and farther it gets away from its 3X3 DMA (blue curved line) and its 14-day SMA (orange curved line), the higher the probability of it returning back to those moving averages.

Further, the S&P 500 once again tested its all-time high of 3,393 again yesterday, but once again wasn't able to post a new all-time high. Whether or not that ends up happening isn't half as important as remembering it does have a strong history of failing on new major highs the first time around.

When we drill down into the VIX Volatility Index, you can see on this daily chart here I've pointed to that one day (seven trading days ago), whereby it closed above its 3X3 DMA, only for it to close back below it the last six trading days. However, despite the S&P 500 moving higher during that time period, the VIX has yet to breach its recent low.

The bottom line is it's very possible if the VIX were to manage to close above 22.15 today, that could be the very first sign of a looming reversal - especially since the VIX has still yet to breach its August 11th low. In other words, should the VIX close above 22.11 today, it will be interesting to see how the S&P 500 starts to behave as soon as tomorrow.

The Economy Vs. The Stock Market - How to Perceive This Historical Transitional Shift and How to Profit From It

I've referenced on a number of occasions over the last few months the similarities between the current stock market environment we're currently in and the great Internet Bubble of the 1990's. Everything from the way speculative growth stocks are behaving to where S&P 500 valuations are now that all of the major indexes are either at or above their all-time highs.

However, there's clearly a strong divergence and transition taking place between the economy, consumers and small businesses, and that of the stock market and corporate America - one that is much different than that of the 1990's. Sure, valuations in many cases are through the roof, but there is still plenty of value out there in certain names and sectors.

Basically, tech continues to drive these markets higher in every way, shape and form. Online learning, cloud services and computing, financial technology, consumer and enterprise technology, artificial intelligence and machine learning, automotive and energy technology, chemicals, robotics and biotech - the list goes on and on.

Then we have the small business landscape, the consumer and a very large base of unemployed Americans continuing to try and find a way to adapt and shift in an effort to not only provide for themselves, but their families as well. While sad in many ways, it all reminds me of a quote from one of Dr. Seuss' books, "Business is business, and business must grow, regardless of crummies in tummies, you know".

While many investors continue to focus on how and why these markets continue to go higher and higher, I truly believe there's one of the biggest shifts in American history taking place right before our very eyes. And, if investors do not become aware of this shift they're going to leave an awful lot of returns on the table over the next few decades.

When it comes to investing, accurate imagination and creativity are extremely important if one is going to generate life changing returns over time. Awareness is more than half the battle, and right now that one single word alone is extremely important for every investor who's looking to capitalize on the stock markets' future, and more importantly the returns it can provide one's hard earned money.

Meaning, as long as you're fully aware of those very few but major transitional shifts that tend to take place within a country over the course of its entire life cycle, and even more rare the world as a whole, then and only then can one identify the right opportunities for tremendous returns.

Now don't get me wrong, stocks and the markets in general will always continue to go up and down. Short-term bear markets and selloffs will always be a part of the markets' macro behavior, so I'm not advocating everyone just run out and blindly snap up anything and everything around current market levels that may seem like the next big thing. However, my goal today is to just bring some awareness to what's actually going on.

When I look around the various sectors of the markets, and those individual companies associated with them, there's no question all of the above is in its infancy when you consider the grand scheme of things over the course of decades. Right now, if Joe's hardware goes out of business, that's good for Home Depot and Lowe's. When Mary's Cafe shuts down, that's good for all of your major restaurant chain stocks.

Over the weekend Yelp provided a report that revealed 60% of the restaurants in America have either shut down, or are on the verge of shutting down. Who's that good for? Target, Walmart, Costco and every other grocery big box store out there. Do I personally like that or think it's right? Absolutely not, but it is what it is.

If you think working remotely, getting an education remotely, shopping or socializing online, playing games online etc. are all just a temporary event due to COVID, think again. All COVID has done is exacerbate the growth in tech, force consumers and businesses into rapid adoption of it all, and train them at light speed to rely on all of it as a way of life. Again, it's sad to me in many ways, but it is what it is.

Then there's the financial system as we've known it for roughly 90 years now. Initially backed by gold and silver prior to 1933, fiat currencies have been a strong debate among many ever since. Backed by oil or simply backed by "full faith and credit" is an argument the world has had regarding fiat currencies for almost 100 years now.

However, even that may be on the verge of changing over the next decade or two. Meaning, it's entirely possible countries could return to a currency backed by precious metals, but in a digitally backed form. I know that may seem crazy, but when you look at the way governments continue to have no regard for the value of their currencies, it's almost as if they know it's going to change. In other words, why not print more money and fix your infrastructures etc. until a point in time the debt can be consolidated by a new form of currency?

I'm not suggesting I agree with the notion of continuing to print more and more money, but the bottom line is when you look at history, and you look at the effect these type of major transitional shifts tend to have economies in general, there's always been carnage in certain aspects of those economies. Therefore, it's important we don't continue to view the economy right now as we have since the advent of the industrial revolution, which in my opinion was the last major transitional shift to take place in this country.

Although things never change in most respects, circumstances and opportunities always do. That's just the evolution of things - always having a tendency to initially disguise themselves in a form of chaos and carnage before prosperity ends up revealing itself again.

My single and only point today is it's very important we either get or remain very aware of what's actually happening. The beauty of the stock market is there's always going to be opportunities, so in essence you can never be too early or too late if you're a long-term investor. You just have to identify what's actually happening, and then look to take advantage of those opportunities without worrying too much about whether you're catching that perfect top or bottom of anything.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst