Client Newsletter Example: Beware of the Value Trap - Tech Still the Play - Top Financial Stocks and Best of Big Tech

Published on November 12, 2020 @ 9:30am

Recent popular questions answered for your education and consideration. Beware of the value trap, as the recent "rotation to value" likely won't last with most of them. NASDAQ leads again, but all eleven S&P 500 sectors do appear a little suspect for very different reasons. Here's which sectors we like, which ones we don't and why. Also, certain stocks in popular categories I think stand the best chance of outperforming their peers on a go-forward basis.

NASDAQ and Big Tech Leads Again - Beware of the Value Trap - Popular Questions Answered

Following some recent strength from the DOW Jones Industrial Average, and certain other underperforming sectors in recent days, buyers came right back into tech yesterday - a theme that's been consistent for 20 years now. And, while we continue to hear the financial media discuss and debate the possibility of a "rotation to value" I felt compelled to cover the topic in detail today.

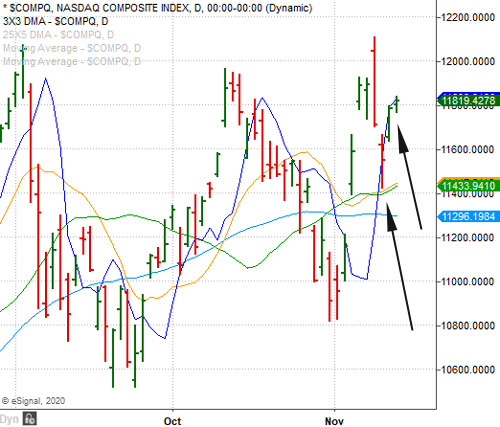

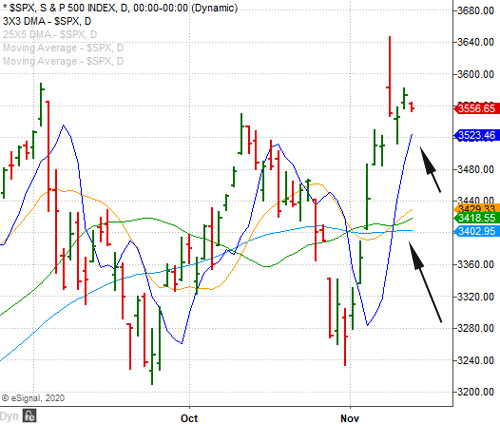

Before I get into this though, provided here are daily charts of both the NASDAQ Composite and S&P 500. As you can see, those key moving averages I've pointed to here have held so far. As a matter of fact, it was those key moving averages on the NASDAQ here that served up the big rally in tech yesterday, along with even more follow through early this morning.

However, I spent the good part of yesterday assessing all of the individual sector ETFs, and I really didn't like what I saw. Meaning, those underperforming sectors that have done so well recently have gotten very far away from their key short-term moving averages to the upside, while darling tech and those other sectors that have done so well over the last eight months appear to be either range-bound, or wobbling enough to be near-term concerned.

These markets have become even more sensitive to news than ever before, so any day can be any kind, but the bottom line is as long as those recent highs are not breached, these markets are still in a position to move lower. We'll see. If you're long the bullish leveraged index ETFs continue to trail your gains, and if you're looking to get short I'd still reserve that for somewhere close to the recent highs. Anything in between is likely to chop one up when it's all said and done.

Now, there's nothing wrong with value - in some cases. Meaning, those stocks that "appear" to offer extremely attractive current valuation metrics. Metrics like a low P/E, a low revenue multiple, or even an attractive dividend can all lure an investor into an idea - especially if the stock in question is down around historically low levels. However, if that value isn't coupled with attractive enough forward growth then the value stock in question often ends up being nothing more than a "value trap".

In other words, the stock goes nowhere, or often times even lower, while the rest of the markets continue higher. It's been going on for a very long time, and it's becoming even more prevalent now. Why? The longer a bull market goes on the more and more it becomes a stock picker's market.

Sure, the stock market is always a stock picker's market, but when the markets are running at extremely high levels the emphasis put on stock picking becomes even more important. Basically, the markets become very fickle around new all-time highs, but while many investors tend to get nervous and start looking for deep value, it's those sectors and individual companies associated with them offering value AND attractive growth that tend to offer the best risk/reward scenarios.

Like anything else in life it's all about balance. There are those attractive growth stocks out there, that from a current valuation perspective can be way too expensive at times. And then of course there's those above mentioned "value trap" ideas that many investors tend to gravitate towards. This is why we work very diligently to identify those growth stocks early, or at the very least those stocks offering GARP (Growth at a Reasonable Price), because in a market environment like the one we're in now it's important not to chase the froth.

Having researched and analyzed stocks for a living for over 20 years now, I can tell you the two biggest mistakes buy and hold investors tend to make are buying into ideas that have literally proven nothing, or buying into those value traps that end up doing nothing while the major indexes simply continue higher and higher. For some reason, investors love to gravitate to low priced stocks that are either too risky or simply going nowhere. Remember, there's always a reason why a stock is trading down around single digits, or even pennies.

Further, there's an awful lot of swirling speculation out there these days about which sectors offer value, growth, and more importantly market average beating returns on a go-forward basis. Everything from banks to oil stocks, airlines and even cruise ships. Then there's an equal amount of speculation suggesting tech has become way too overvalued.

I can tell you this... there's opportunities in every single sector, but from purely a sector perspective it's those banks, airlines and cruise ships that probably aren't going to offer the long-term investor market average beating returns. And, until the fundamental backdrop for driving and flying changes dramatically, most oil names in the energy sector probably aren't going to offer investors much of the same. And I'm not necessarily referring to a change in the whole pandemic landscape.

Sure, all of these sectors, and the individual stocks associated with them, will rally sharply from time-to-time on a short-term basis. Even the worst ideas can bounce big, but when we're referring to investing vs. trading and I look around all of the "value" prospects out there within these sectors, their forward growth metrics are often anemic to sometimes even horrific. Meaning, negative growth over the next five years.

This brings us to tech, healthcare, consumer discretionary, non-discretionary, electronic gaming, industrials, metals, basic materials, digital currencies, biotech, non-bank financial (like fintech and blockchain), green energy, and even non-airline transportation. As a very large group, this continues to be our focus. When you compare the growth prospects within these sectors to those typically underperforming sectors mentioned above, you'll start to realize where the money is going and where the profits are likely to end up being.

To sum it up, I have no allegiance to any one sector. However, banks, airlines, cruise ships and REITS are among my least favorite sectors in this current market environment - pandemic or no pandemic it doesn't matter to me. For all of the reasons I mentioned above, we continue to stick with those sectors and individual companies that are offering attractive growth at a reasonable current valuation/price.

Lastly, I receive a number of questions every day asking about certain sectors, stocks, ETFs and investment themes, so I thought I'd share some of those questions today, along with updated answers...

Is tech still a good investment or should we be focusing on other sectors? Absolutely and yes, but it's important to remain selective because quite honestly the growth rates for the majority of the MFAANGT stocks (T is for Tesla) are becoming somewhat less attractive. As a matter of opinion, if I had to choose only two of the seven it would be AMZN and TSLA. Did I just say Tesla? Yes, things change.

When you compare the growth rates of Tesla and Amazon to that of Microsoft, Facebook, Apple, Alphabet and Netflix it's a no brainer to me. Still, despite the fact we're starting to see a number of up and coming tech plays with far more attractive growth rates, MSFT, FB, AAPL, GOOGL and NFLX will likely continue to outperform most other mega cap stocks out there, which is why we're still such big fans of QQQ on a long-term basis.

Should I be investing in China? China stocks are usually feast or famine, and considering the fact the China government is a state sponsored enterprise system, I'd be very careful owning any one individual China stock. It's literally impossible to know when their government is buying or selling a stock in droves. This is why the movement in most China stocks will always be extreme in both directions. I don't and won't recommend China stocks for this very reason. They're fine when they're working, but disastrous when they're not.

Which bank stocks do you like? None, but if I were forced to buy one or two it would probably be JPM or GS (preferably GS), as both will likely have a say in blockchain and both are best of breed when compared to all of the other regional and national banks out there. However, when it comes to financials SQ and PYPL are two stocks I do believe every investor should own a piece of on a long-term basis - especially if they take a hit in the weeks or months ahead.

Digital Currencies? Yes. We continue to maintain exposure to the primary ETF tracking Bitcoin in GBTC, as it has dramatically outperformed the broader markets in recent months. However, I'd be careful about many of those alt. coins in the digital currency space, as I liken them to overly speculative small and micro cap stocks that have proven nothing in the grand scheme of it all.

Which defense stocks do you like? Right now, the only two I would consider owning are BA and TDY, as both have the most attractive growth rates in the defense sector. Everything else in the defense sector just doesn't seem to offer much in the way of long-term growth yet.

What are a few metal stocks with the most attractive growth rates going forward? PAAS and GOLD. There are others, but these two in my opinion are safer and more fundamentally attractive going forward.

As you can see, we maintain a very clear and strict methodology when it comes to which type of stocks we're willing to suggest and which ones we won't. An individual idea must meet certain fundamental criteria, while also looking technically attractive at the time I put one out there. Does it mean I'm always going to be right? Of course not. However, the more context (technical and fundamental) one has for entering into an idea, the higher and higher the probability of that idea working out becomes.

Even when it comes to short-term trading, I've always said why trade a fundamentally unattractive stock when you can trade a fundamentally attractive stock? There's roughly six thousand stocks to choose from out there between the NASDAQ and NYSE, so it's not as if we need to focus solely on which charts are going to do well. Instead, we like to suggest stocks that not only look technically attractive, but more importantly fundamentally attractive on a long-term basis. It just reduces the potential risk, while increasing the potential reward.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst