Client Newsletter Example: Must Read Most Important Rules for Trading/Investing - WMG Reports - Markets Bounce

Published on February 2, 2021 @ 10:54am

Warner Music Group Corp. (WMG) meets earnings estimates, but beats top line estimates. As expected, the major indexes bounced sharply yesterday after holding their last key short-term moving averages. Index traders looking to get short this is where you'd do it, but plan the trade and trade the plan. Silver and several spec. names back off recent highs - once again proving there are certain rules traders/investors should adhere to in this current market environment. Only participate in high quality names with reasonable current valuation metrics and attractive forward growth that look technically attractive at the time. Don't chase anything higher (if getting long) or lower (if shorting), but instead remain patient and let it come back to you. Be completely pragmatic/objective and don't let your emotions/feelings get the best of you. Pay close attention to the technicals, and know your risk tolerance, timeframes and strategy.

WMG Reports - Major Indexes Bounce Sharply - Most Important Rules to Trading/Investing Now and Forever

Before I get into what I believe to be the most important psychological aspects of trading/investing in anything in this day and age, I want to quickly point out one of our current open ideas in Warner Music Group Corp. (WMG) had a good enough earnings report yesterday to keep our bullish opinion of the idea intact. The Company reported earnings of $.19 cents per share on revenue of $1.34B. Analysts were expecting earnings of $.19 cents per share on revenue of $1.25B.

Although we clearly would have liked to see an earnings beat, the top line beat was a welcomed event, and like I mentioned yesterday the Company's forward growth rate is still among the more attractive growth rates out there. So, we'll continue to stick with the idea and look for higher levels ahead. It's only a matter of time.

As expected, after achieving those last final short-term moving averages on Friday, all of the major indexes bounced sharply to close out the day yesterday. This once again proves a few of the most important rules to trading/investing in this current market environment: remain completely pragmatic/objective about what these markets are capable of, pay close attention to the technicals, and avoid relying too much on one's feelings/emotions.

Basically, all of the major indexes proved their resilience yet again yesterday, and they did it around very logical technical levels. As a matter of fact, it was those last key short-term moving averages yesterday that were expected to serve up a bounce, and possibly even take these markets on to new all-time highs.

Although we've clearly yet to achieve new all-time highs again, everyone should know by now what these markets are capable. Meaning, no matter what politics are suggesting or what the financial media is spewing, it's still all about interest rates, momentum and revenue/earnings - in that order. Those are the three most important components to the ongoing behavior of these markets, and that's likely never going to change.

Sure, there are going to be unexpected major geopolitical and black swan type events like 9/11 and COVID, but as long as nothing like that surfaces it's still all about the BIG 3 - interest rates, momentum and revenue/earnings. And, anyone that tells you otherwise doesn't have a pulse on these markets. Case in point, it doesn't matter who's President until the President or administration in question changes a policy that could have a dramatic effect on a sector, a stock or the markets as a whole.

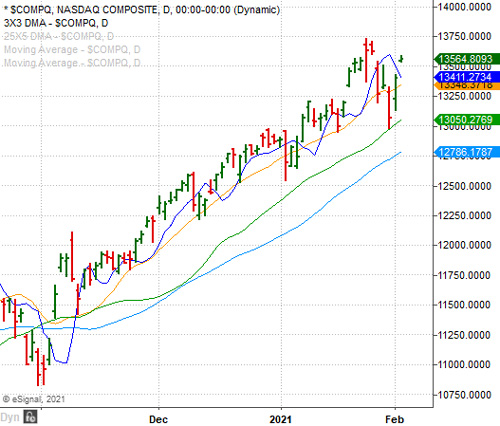

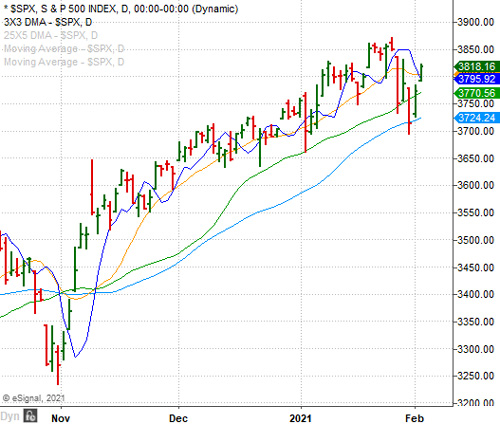

With that, it was all about momentum yesterday. Provided here are daily charts of both the NASDAQ Composite and S&P 500. As you can see, not only did those last final short-term moving averages hold yesterday, the markets built on them for the umpteenth time in several years. All very normal.

However, yesterday proved once again short-term index traders must remain very tactical and surgical - buying the extreme logical lows around the most important short-term moving averages, use tight enough protective stops, and then sell or short the big rips once the instrument in question has gotten too far away to the upside from its key short-term moving averages.

If you can't or don't have the time for that, it's always best to adopt the buy and hold strategy, or simply give an idea enough time to work itself out and then take the profits when they're there, because as long as you're in the right high quality names they're going to work out when it's all said and done.

This also brings me to another very important rule traders/investors should always adhere to: never chase anything higher or lower unless you're getting in during the very early stages of an expected upside/downside expansion. Meaning, depending on your trading/investing timeframe and strategy, it's best to take the profits on the big run-ups, and then let the idea come back to you. Conversely, when you're looking to short something, wait for the big bounce or run-up and short from there.

Although the buy and hold strategy should only ever be focused on two things (buying very good fundamentally attractive companies when the charts look good enough), the short-term trader must always deal with risk management and positioning - especially since things in this market environment are moving VERY quickly from day-to-day.

This is why I prefer to teach short-term traders to use the most important moving averages to make decisions. These markets are making big moves in a very short amount of time - sometimes all in an hour, so the bottom line is it's extremely important for the short-term trader to be proactive rather than reactive. Reactive traders are getting whipsawed in a New York Minute, while proactive traders continue to better position themselves from a risk management perspective.

So what now for the major indexes and broader markets as a whole? If they're going to reverse themselves back to the downside they should start doing it today. If they don't there's a very high likelihood of more new highs ahead. Both the NASDAQ and S&P have found themselves back up against a few of their more important short-term moving average, so if they're going to prove resistant that should come today.

Further, the VIX has now come back to another logical level that would suggest if these markets are going to back off again, this is where they should do it. More specifically, anywhere between where the VIX is now and roughly 25, so that's where another entry or re-entry into UVXY or VXX would pose the least amount of risk.

Provided here is an hourly bar chart of the VIX Volatility Index spanning the last several days. As you can see, it has now come back to a level that would suggest another attractive entry for those looking for a hedge against a potential market downturn soon, or simply looking to speculate on another wave lower for the major indexes. You'll just need to be careful in the event either index wants to test its recent high. If that happens, we're probably making new highs, so don't be stubborn.

Now would also be the time for index traders to potentially test a market short via any of the bearish leveraged index ETFs. You're just going to have to use a tight protective stop you're comfortable with though in the event these markets make new all-time highs again. For anyone who decided to get long the bullish leveraged index ETFs around their recent moving average lows, just make sure you raise your stops way up and let it work from there. Again, it's all about risk management.

As for silver, a number of SPACS and many of the individual names out there, many are getting pounded today - once again proving profit taking when it's there is prudent, but more importantly why it's so important not to chase anything higher - especially if the name in question is fundamentally suspect. Meaning, the fear of missing out is never good enough context to be buying anything.

After gapping sharply higher on the financial media's notion silver was going to be the next big short squeeze, the metal has backed off sharply this morning - trapping yesterday's silver buyers into now waiting for an eventual breakout. Another perfect example of traders/investors chasing something higher on the fear of missing out. This is precisely why I didn't suggest buying silver yesterday, and more importantly why we did suggest buying the silver ETF in SLV last Summer when it was down around historically low levels.

I know this sounds so cliche but it really is all about buying low and selling high. Sounds simple right? Well, if you've been around the markets long enough, and watched the behavior of new traders/investors along the way, then you know greed, fear of loss, and the fear of missing out can make buying low and selling high a real problem for many.

Therefore, I'd strongly suggest everyone here take stock of their emotions/feelings, continue to stick with their trading/investing timeframes and strategies, continue to remain completely objective/pragmatic about all of the possibilities, and only participate in high quality fundamentally attractive names that look technically attractive at the time. Everything else isn't for me or for us.

If we all collectively do this, we're all going to be far more right than wrong, and more importantly consistent with our success over time - especially if we continue to manage risk accordingly and give the right idea enough time to work out. There's no question very short-term charts can be tricky at times, which is why long-term charts and long-term fundamentals always win in the end.

Current Stance for Equities:

Create a Free Trial Here To See Our Current Stance for Equities: https://www.vikingcrest.com/register

Suggested Long-Term ETF Holdings:

Create a Free Trial Here To See Which ETFs We Continue to Suggest Investors Maintain Exposure To: https://www.vikingcrest.com/register

Individual Company Ideas:

Create a Free Trial Here To See Which Stocks We've Recently Suggested: https://www.vikingcrest.com/register

Important Strategy Tips On Trading, Investing, Portfolio Management and Using Our Service

Very important for any trader and investor who wants to be successful. To review a list of rules and disciplines to consider go here: https://www.vikingcrest.com/article/88. It's a good idea to review this article from time-to-time for any newly added rules.

To view our current trading ideas log-in here: https://www.vikingcrest.com/member. If you have any questions regarding a specific stock - even if it's something we haven't suggested - you can reply directly to this email, or call us at 619-369-9316.

John Monroe - Senior Editor and Analyst